Corporate Recovery Service Market to Hit US$ 228.8 Million by 2032, at a CAGR of 6.3% | Coherent Market Insights

Burlingame, CA, Sept. 04, 2025 (GLOBE NEWSWIRE) -- Corporate Recovery Service Market to Hit USD 149.2 Million by 2025 Amid Growing Corporate Insolvencies

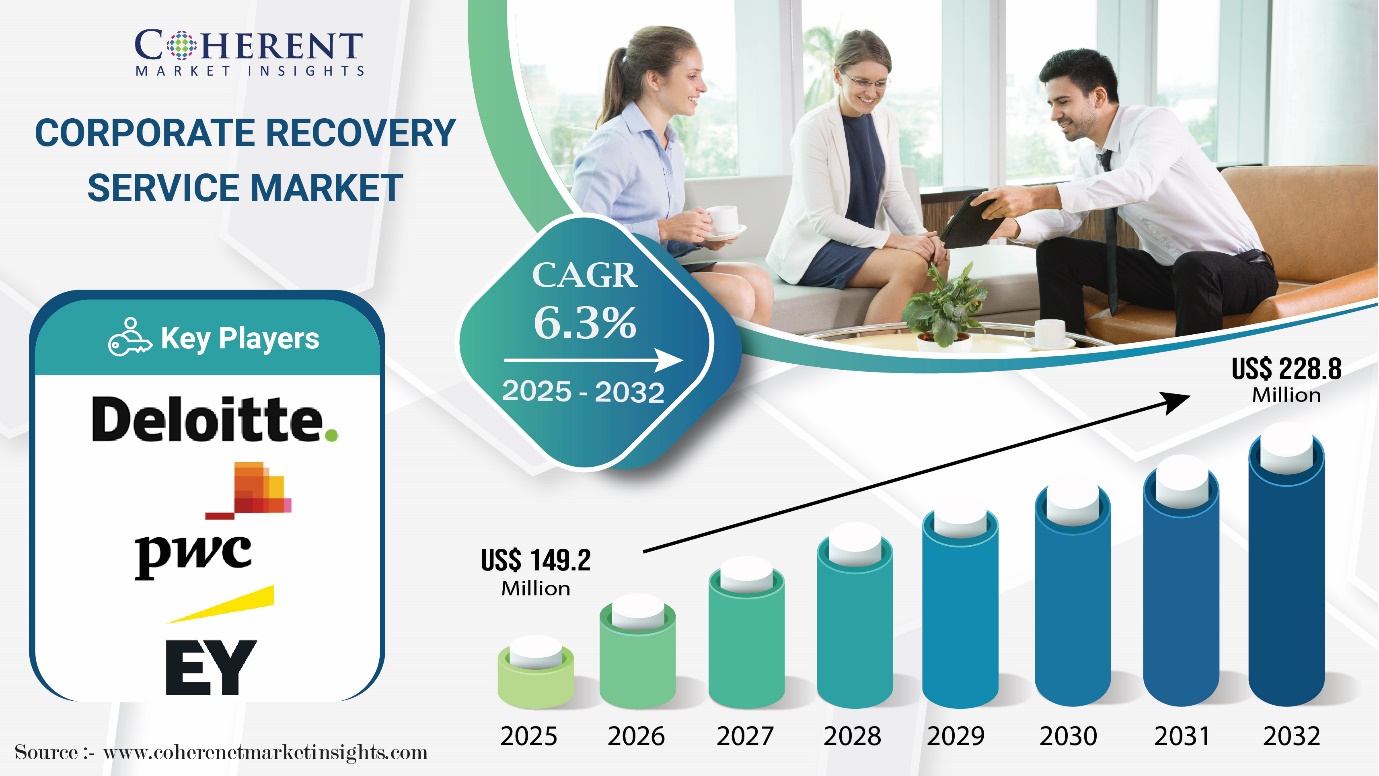

The Global Corporate Recovery Service Market is estimated to be valued at US$ 149.2 Mn in 2025 and is expected to reach US$ 228.8 Mn by 2032, exhibiting a compound annual growth rate (CAGR) of 6.3% from 2025 to 2032. The corporate recovery service market is projected to experience positive growth during the forecast period. This growth is driven by an increase in insolvency cases among large enterprises and the availability of cost-effective recovery service solutions. Furthermore, changes in bankruptcy laws that favor creditors are expected to boost the demand for these services. Large enterprises are increasingly investing in recovery services to reduce losses caused by non-performing assets.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/7859

Global Corporate Recovery Service Market Key Takeaways

According to Coherent Market Insights (CMI), the global corporate recovery service market size is projected to expand at a CAGR of 6.3% during the assessment period, increasing from USD 149.2 Mn in 2025 to USD 288.8 Mn by 2032.

Administrative takeover segment is set to account for nearly 2/5 of the global corporate recovery service market share in 2025.

North America is expected to maintain its dominance, capturing a 35.3% share of the global market by 2025.

Asia Pacific is poised to emerge as a hotbed for corporate recovery service providers during the forecast period.

Increasing Corporate Insolvencies Spurring Market Growth

Coherent Market Insights’ latest corporate recovery service market analysis highlights major factors driving the industry’s growth. One such key growth factor is the rising corporate distress and insolvencies.

Global economic pressures such as inflation, high borrowing costs, supply chain disruptions, and geopolitical uncertainties are leading to increased corporate insolvencies. This surge is boosting demand for corporate recovery services.

According to Allianz Trade, global business insolvencies are expected to rise by 6% in 2025 and 3% in 2026. This will likely create a fertile ground for the growth of corporate recovery service market during the forecast period.

High Implementation Costs Limiting Market Growth

The global corporate recovery service market outlook appears promising. However, high implementation costs for SMEs are slowing down market growth to some extent.

The financial burden of engaging professional recovery services often deters small and medium-sized enterprises (SMEs) from seeking necessary assistance. This can limit the corporate recovery service market demand during the forthcoming period.

Rising Demand for Specialized Recovery Services Opening Revenue Streams

There is a rising need for specialized recovery services like restructuring advisory, insolvency administration, and forensic accounting. These services are essential for businesses to manage distress and maintain continuity. As a result, promising growth opportunities are on the horizon for corporate recovery service companies.

The globalization of business and the rise of multinational corporate structures are leading to complicated cases of bankruptcy and struggling assets across different countries. Handling these situations requires expert knowledge of legal and financial rules in multiple regions. This is creating new revenue opportunities for corporate recovery service providers.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7859

Impact of AI on the Corporate Recovery Service Market

Artificial intelligence (AI) is throwing new life into the corporate recovery service market. It is driving efficiency, accuracy, and strategic decision-making.

AI-powered tools enable companies to analyze vast amounts of financial and operational data quickly. Similarly, they identify distressed assets, potential risks, and recovery opportunities with greater precision.

Predictive analytics and machine learning models help forecast cash flow issues and optimize restructuring strategies. By doing so, they reduce the time as well as cost associated with corporate recovery processes.

HandsOn Global Management’s launch of Recovery AI is one recent example for this trend. This AI-based tool helps law firms and financial institutions find and recover stolen or misused assets by analysing complicated data collected through legal discovery.

Emerging Corporate Recovery Services Market Trends

Shift towards preventive solutions is a key growth-shaping trend in the corporate recovery services. Companies are increasingly seeking services for preventive restructuring. This contributes to rising demand for corporate recovery services.

Rising incidence of cyberattacks is increasing the demand for corporate recovery services. Companies today are spending more on these services to safeguard important data and keep their business running during cyber threats.

Hybrid corporate recovery services are gaining popularity due to their scalability, flexibility, and cost-efficiency. Rising adoption of these hybrid services will likely boost the corporate recovery service market value in the coming years.

Continuous improvements in technology are helping the market grow. Using advanced tools like AI, big data, and cloud computing is changing the way recovery services work. These technologies allow faster, smarter solutions, making recovery processes more efficient and easier to expand.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7859

Analyst’s View

“The global corporate recovery service industry is set to grow rapidly, owing to rising corporate insolvencies, escalating demand for specialized recovery services, increasing cybersecurity concerns, and ongoing technological advancements,” said a lead CMI analyst.

Current Events and Their Impact on the Corporate Recovery Service Market

| Event | Description and Impact |

| 2025 Global Banking Sector Stress |

|

| Energy Market Volatility in Europe (2025) |

|

| AI-Driven Disruption in Traditional Industries |

|

Competitor Insights

Key companies in the corporate recovery service market research report:

- Deloitte

- Grant Thornton

- Ernst & Young (EY)

- Alvarez & Marsal

- PricewaterhouseCoopers (PwC)

- Baker Tilly

- KPMG

- BDO

- CBIZ, Inc.

- Hall Chadwick Melbourne Pty Ltd

- Buchler Phillips

- PKF International

- Moore Kingston Smith

- Business Victoria

- MENZIES LLP

Market Segmentation

Type Insights (Revenue, US$ Mn, 2020 - 2032)

- Administrative Takeover

- Compulsory Liquidation & Creditor Voluntary Liquidation

- Voluntary Management

- Others

Key Developments

In April 2025, Alvarez & Marshal launched corporate finance practice in Germany. The new business unit is designed to assist companies in managing the complexities associated with selling or restructuring their businesses

In June 2025, Cohesity and 11:11 Systems unveiled new Clean Room Recovery service to improve cyber resilience. The service is designed to help businesses rapidly respond to ransomware and other advanced cyberattacks and restore their operations.

Also Read:

Cloud Backup & Recovery Software Market Outlook for 2025-2032

Business Assurance Market Size, Share, Trends & Opportunities for 2025-2032

Corporate Liquidity Management Market Analysis and Forecast for 2025-2032

Our Trusted Partners:

Worldwide Market Reports, Coherent MI, Stratagem Market Insights

Get Recent News:

https://www.coherentmarketinsights.com/news

About Us: Coherent Market Insights leads into data and analytics, audience measurement, consumer behaviours, and market trend analysis. From shorter dispatch to in-depth insights, CMI has exceled in offering research, analytics, and consumer-focused shifts for nearly a decade. With cutting-edge syndicated tools and custom-made research services, we empower businesses to move in the direction of growth. We are multifunctional in our work scope and have 450+ seasoned consultants, analysts, and researchers across 26+ industries spread out in 32+ countries. Contact Us: Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Pvt Ltd, 533 Airport Boulevard, Suite 400, Burlingame, CA 94010, United States Phone: US: + 12524771362 UK: +442039578553 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com For Latest Update Follow Us: LinkedIn | Facebook | Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.